Thukten Zangpo

Following a directive from the Royal Monetary Authority (RMA), Bhutan Development Bank Limited, Royal Insurance Corporation of Bhutan Limited, and National Cottage and Small Industry (CSI) Development Bank temporarily suspended disbursing loans due to their high non-performing loans (NPL).

These financial institutions (FIs) suspended the sanction of new loans from May 13 this year. The RMA also asked the FIs to come up with the remedial measures to resolve NPL. NPL are loans with payments that are overdue by 90 days or more.

Chief Executive Officer of the Bhutan Development Bank Limited, Phub Dorji said that the bank had submitted remedial measures. “Our submission was that the bank will try to bring down the NPL at the lowest possible level.”

He added that the bank also requested the RMA to let it allow lending because people are dependent on the financial services the bank provides.

National CSI Development Bank CEO, Kinzang said that the bank had submitted the remedial measures to the RMA, however, the RMA has asked to improve and submit the measures by the end of this month.

National CSI Bank’s non-performing loans reached 5.23 percent of the total loans disbursed since its operations began two years ago. It spiked to over 11 percent in March this year which is higher than the RMA’s threshold for NPL of 5 percent for the bank. The manufacturing and production sector recorded the highest NPL.

Statistics with the RMA show that the National CSI Development Bank’s overall NPL ratio accounted for 12.6 percent, as of June 2021 as compared to 40 percent in June 2020.

As of April, this year, the National CSI Development Bank has disbursed the loans of Nu 2.06 billion (B) to 6,249 clients.

Statistics also show that the NPL of all financial institutions dropped to 14.1 percent (Nu 24.24B) as of June 2021 compared to 16.4 percent (Nu 26.66B) in June 2020.

Of the total NPL, the banks accounted for 61.8 percent, with the highest in Bhutan Development Bank Limited at 21.6 percent, followed by Bhutan National Bank Limited at 20.6 percent, and Bank of Bhutan Limited with 14.8 percent as of June 2021.

Meanwhile, the bank’s NPL ratio has decreased to 11.5 percent in June 2021 from 14.5 percent a year ago.

Under non-bank, Royal Insurance Corporation of Bhutan Limited accounted for 36 percent of the total NPL share, and Bhutan Insurance Limited with 1.8 percent.

The NPL ratio of non-banks remains elevated from 21.9 percent in June 2020 to 22.4 percent in June 2021.

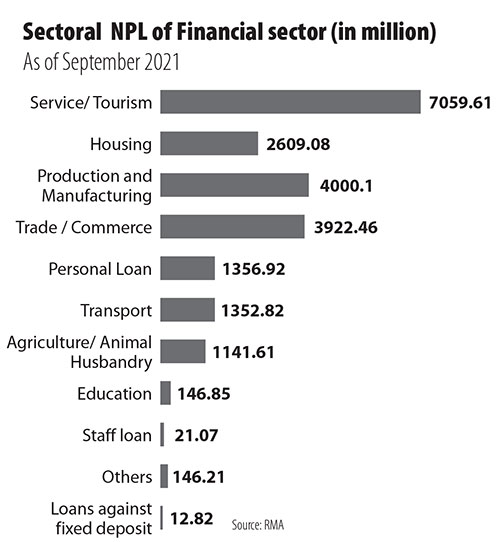

The service and tourism sector recorded the highest NPL with 32 percent (Nu 7.06B),the manufacturing sector with 18 percent (Nu 4B) and the trade and commerce sector with 18 percent (Nu 3.92B). While the housing sector saw an NPL of 12 percent equivalent to Nu 2.61B as of September 2021.

It was found that these sectors accounted for 80 percent of the total loans and were impacted by the Covid-19 pandemic.

“If the pandemic’s economic effects prove to be acute and persistent in the medium to long term, financial institutions would be under stress and a significant portion of distressed loans may ultimately require repayment extension and restructuring,” according to the RMA’s financial sector performance report.