Domestic debt decreases by 32.8 percent

Thukten Zangpo

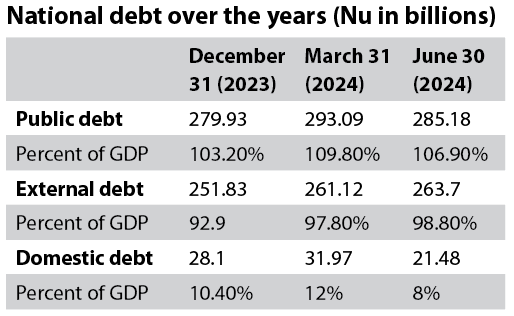

The country’s national debt saw a decrease by 2.7 percent or Nu 7.9 billion as of June compared to March this year.

According to the finance ministry, the debt reached Nu 285.18 billion, equivalent to 106.9 percent of the estimated GDP for the fiscal year 2023-24, which is considered manageable.

This was mainly due to a decrease in domestic debt by 32.8 percent, or Nu 10.49 billion, reaching Nu 21.48 billion as of June.

Domestic debt’s percent to GDP saw a decrease from 12 percent to 8 percent, while its share to total debt declined to 7.5 percent from 10.9 percent.

The domestic debt consisted of Nu 379.31 million overdraft outstanding and Nu 21.1 billion government bonds.

According to the finance ministry, when the National CSI Development Bank (NCSIDB) merged with the Bhutan Development Bank Limited (BDBL), the ministry’s borrowings and lending were restructured to clean the balance sheet of the transferee bank (BDBL).

The ministry added that the on-lending of Nu 700 million by the ministry to NCSIDB was adjusted against the 10-year government bond (RGoB003) subscription by BDBL, leaving the bank with Nu 800 million worth of this bond out of a total of Nu 2.3 billion.

The ministry also stated that it prematurely liquidated the government’s 5-year bond (RGoB009) amounting to Nu 1 billion on April 11 this year.

“This action reflects a strategic decision to optimise the government’s debt portfolio, reduce future interest obligations, and maintain fiscal discipline,” the ministry said.As part of the prudent cash management and a commitment to fiscal consolidation by curtailing unnecessary expenditures, the ministry closed the government consolidated account with a zero balance of treasury bills (T-Bills).

T-Bills accounted for Nu 9.87 billion of domestic debt in March this year.

However, the external debt saw a marginal increase of one percent, or Nu 2.58 billion, reaching Nu 263.7 billion as of June this year. It comprised 92.5 percent of the total debt.

This was mainly because of an increase in government debt.

External debt, owed by the government (on-lent to public corporations, including hydropower), corporations, and the central bank (standby credit facility from India), stood at Nu 240.87 billion, Nu 12.83 billion, and Nu 10 billion, respectively.

The hydro-debt of six hydropower projects—Mangdechhu, Puna-I, Puna-II, Nikachhu, Dagachhu, and Basochhu—stood at Nu 167.19 billion, accounting for 63.4 percent of the total external debt as of June this year.

Non-hydro debt stood at Nu 96.51 billion, which constituted 36.6 percent of the total external debt.

INR-denominated debt was reported at Nu 172.57 billion, accounting for 65.4 percent of the external debt. Meanwhile, convertible currency debt stood at USD 1.09 billion (Nu 91.14 billion).

The finance ministry estimated that debt service would account for 26.8 percent of government revenue for the fiscal year 2023-24.

It added that the debt service is within the threshold prescribed in the Public Debt Management Policy 2023, which is total debt service to domestic revenue below 35 percent.

At the same time, the central government debt (non-budgetary debt) stood at Nu 99.66 billion, constituting 34.9 percent of the public debt and 37.3 percent of the estimated GDP.

The ministry stated that it is within the threshold since the Public Debt management Policy 2023 requires central government debt to be within 55 percent of annual GDP.

The sovereign guarantee stood at Nu 4.44 billion, accounting for 1.7 percent of the fiscal year 2023-24 GDP estimate.