MB Subba

In what is one of the few positive impacts of the Covid-19 pandemic, digital payments increased at an unprecedented rate during the lockdown since January 16.

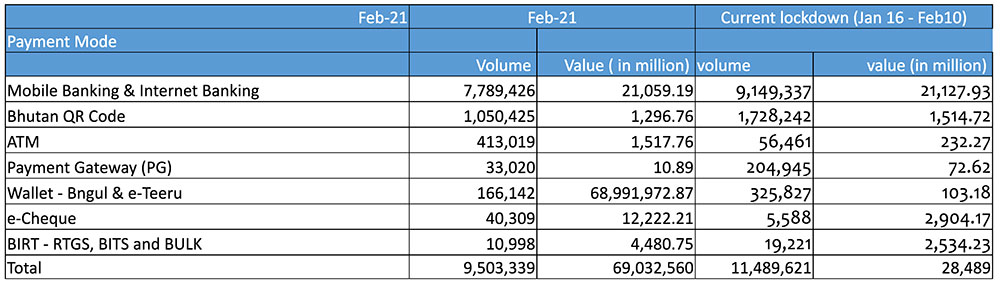

A total of 11.49 million (M) digital payment transactions amounting to Nu 28.48 billion (B) was recorded in the first 26 days of the current lockdown, according to the Royal Monetary Authority (RMA). The RMA recorded an average daily digital transaction of 442,000 during the lockdown, which is much higher than that of the pre-lockdown days.

The authority recorded an average number of daily digital transactions in the pre-lockdown days at 366,000.

The table depicts the digital transaction volumes and their values in the ongoing lockdown and that of that same period of 2021

“Following the 24-hour blackout announcement on January 16, 2022, the central bank and financial service providers have been operating under a containment mode to render uninterrupted essential financial services to users across the country through the digital platforms,” the RMA stated.

The identified essential financial services include retail payments, P2P (Peer to peer payments) fund transfer, large value fund transfer, cross border transactions and remittances, and cash and credit services by the commercial banks.

The daily record of digital payment transactions revealed that mobile and internet banking dominated the retail domestic payment space with 79.63 percent followed by Bhutan QR Code with 15.04 percent.

For large value fund transfers and recurrent payments such as salary, loan, and pension disbursement, the RMA observed that along with e-cheque, Bhutan Inter Bank Real Time (BRIT)-Funds Transfer System previously known as GIFT payment system were used by entities and agencies.

The financial service providers recorded a total of 19,500 transactions amounting to Nu 2.53B using the digital systems.

Additionally, the RMA and financial service providers facilitated the transfer of foreign currency across the border (outward remittances) for meeting payments towards the import of essential goods and services.

The RMA stated that it facilitated the opening of non-resident Bhutanese accounts through RemitBhutan and issuance of annual travel schemes both in INR and USD for Bhutanese travelling abroad.

A total of 3,413 bank accounts, 2,879 Mobile Wallets and 17 non-resident Bhutanese accounts through RemitBhutan were opened during the ongoing lockdown.

According to officials, launching of various digital mobile apps and payment systems had facilitated the transactions during the lockdown.

Digital payments avoid physical cash and ATM withdrawals, which has a higher risk of Covid-19 transmission.

RMA also stated that since the first lockdown, the numbers of customers switching to mobile banking payments and mobile wallets have drastically increased.